Autonomous Vehicle Market Size Worth USD 4,450.34 Billion by 2034 Driven by AI Growth

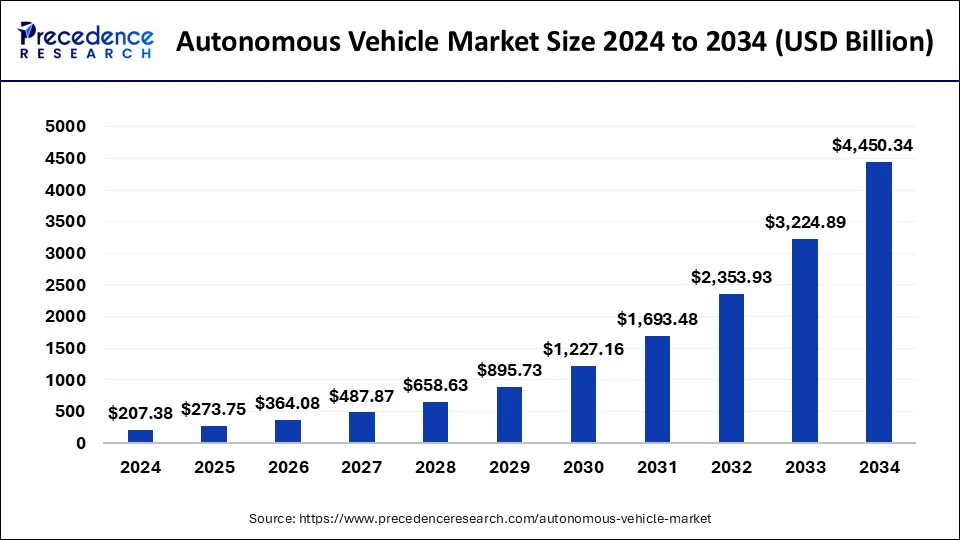

According to Precedence Research, the global autonomous vehicle market size will grow from USD 273.75 billion in 2025 to nearly USD 4,450.34 billion by 2034, expanding at a double-digit CAGR of 36.30% from 2025 to 2034. The autonomous vehicle market is driven by continuous development in AI technology.

Ottawa, Sept. 09, 2025 (GLOBE NEWSWIRE) -- The global autonomous vehicle market size is expected to be worth over USD 4,450.34 billion by 2034, increasing from USD 207.38 billion in 2024. The market is poised to grow at a compound annual growth rate (CAGR) of 36.3% from 2025 to 2034.

Autonomous Vehicle Market Key Insights:

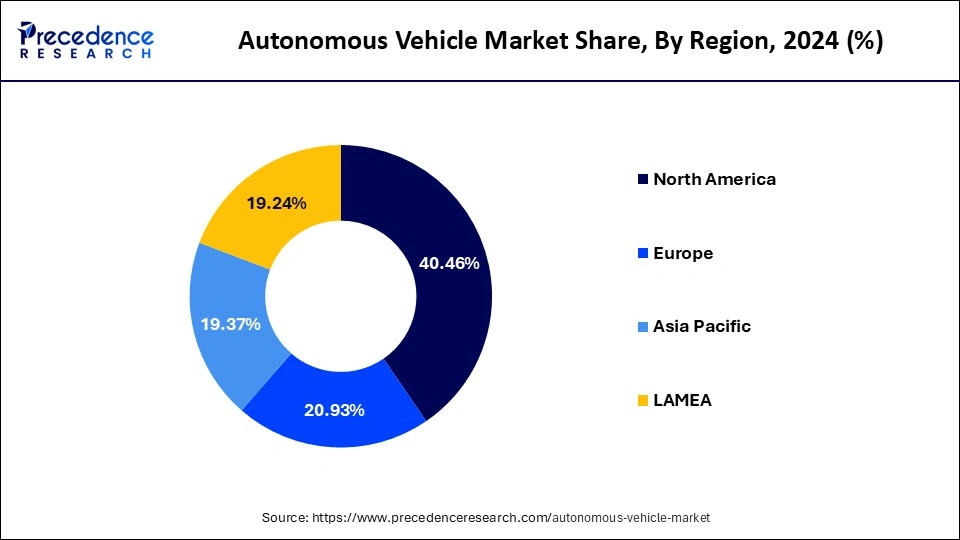

- North America accounted for the largest market share of 40.46% in 2024.

- Asia-Pacific is growing at a notable CAGR of 36.9% from 2025 to 2034.

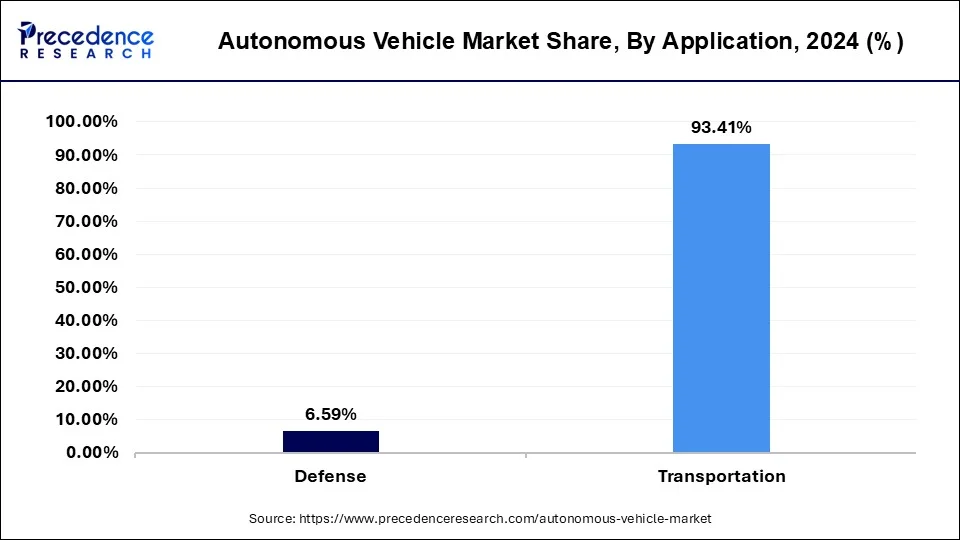

- By application, the transportation segment held the major market share of 93.41% in 2024.

- By vehicle type, the passenger segment accounted for the highest market share of 74.44% in 2024.

- By propulsion type, the semi-autonomous vehicle segment held the largest market share of 95.19% in 2024.

- By transportation, the commercial transportation segment contributed the major market share of 85.17% in 2024.

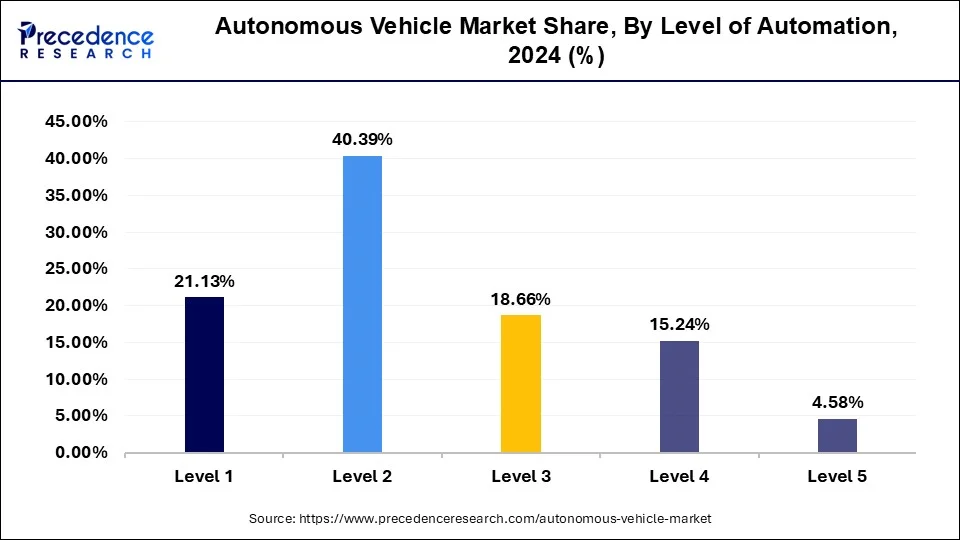

- By level of automation, the Level 2 segment generated the highest market share of 40.39% in 2024.

Global Autonomous Vehicle Market Size by Application, 2022-2024 (USD Billion)

| Application | 2022 | 2023 | 2024 |

| Defense | 10.05 | 13.22 | 17.53 |

| Transportation | 111.73 | 145.09 | 189.85 |

Global Autonomous Vehicle Market Size by Vehicle Type, 2022-2024 (USD Billion)

| Vehicle Type | 2022 | 2023 | 2024 |

| Semi-autonomous | 161.58 | 210.61 | 276.62 |

| Fully Autonomous | 14.45 | 18.55 | 24.00 |

Global Autonomous Vehicle Market Size by Level of Automation, 2022-2024 (USD Billion)

| Level of Automation | 2022 | 2023 | 2024 |

| Level 1 | 22.41 | 29.23 | 38.41 |

| Level 2 | 49.39 | 64.35 | 84.48 |

| Level 3 | 20.18 | 26.32 | 34.60 |

| Level 4 | 17.81 | 23.34 | 30.82 |

| Level 5 | 11.99 | 15.08 | 19.08 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1074

Autonomous Vehicle Market Overview

The autonomous vehicle market is significant because it promises raised road safety by decreasing human error-related accidents, greater efficiency by improving traffic flow and logistics, and improved accessibility for elderly as well as disabled individuals. Through communication along with optimized routing, autonomous vehicles can smooth out traffic flow, decrease congestion, and shorten travel times.

The market fuels innovation, contributing to new forms of shared mobility services as well as increasing productivity by permitting passengers to usage travel time for other activities. Environmental concerns along with the demand for more sustainable transportation alternatives are major drivers, as electric autonomous vehicles can decrease the carbon footprint.

Latest Trends in the Autonomous Vehicle Market

- Advancement in AI and Machine Learning: Autonomous vehicles are increasingly leveraging sophisticated AI algorithms and deep learning to improve perception, decision-making, and real-time navigation.

- Expansion of Sensor Technologies: Integration of LiDAR, radar, cameras, and ultrasonic sensors is becoming more refined, enabling better object detection and environmental mapping.

- Growth of Autonomous Ride-Hailing Services: Companies are piloting and scaling autonomous ride-sharing fleets, aiming to reduce costs and improve urban mobility.

- Development of Level 4 and Level 5 Autonomy: There is a growing push towards achieving full autonomy with no human intervention, with many companies testing vehicles in complex environments.

- Regulatory Frameworks Evolving: Governments worldwide are developing safety standards, liability laws, and testing protocols to facilitate the safe deployment of autonomous vehicles.

- Vehicle-to-Everything (V2X) Communication: Enhanced connectivity between vehicles and infrastructure is improving traffic management, safety, and coordination for autonomous driving.

- Electrification Coupled with Autonomy: Many autonomous vehicles are electric, aligning with environmental goals and offering synergy between clean energy and advanced mobility.

Autonomous Vehicle Market Opportunity

Rising Demand in Smart Cities:

Integration with smart city infrastructure is a major opportunity for autonomous vehicles because it enables improved efficiency, safety, along with sustainability in urban transportation. Smart cities use technologies such as internet of things (IoT) and artificial intelligence (AI) to enhance traffic flow, which assists autonomous vehicles navigate smoothly, decrease congestion, and avoid hazards. By improving routes together with reducing traffic jams, autonomous vehicles in a smart city ecosystem can remarkably lower fuel consumption as well as carbon emissions, leading to a more environmentally friendly urban environment.

Autonomous Vehicle Market Key Challenges

High Development Cost:

High development and infrastructure costs limit the autonomous vehicle market by raising the price of vehicles, demanding significant investment in sensor technology and even complex software, and necessitating costly updates to smart traffic systems and communication networks for widespread adoption.

Developing the complex software, deep neural networks, and even AI algorithms needed for autonomous driving demands massive investment in research and development. Widespread adoption demands significant infrastructure upgrades, like smart traffic systems, advanced sensors, and roadside connectivity devices, to facilitate vehicle-to-everything communication.

Autonomous Vehicle Market Report Coverage

| Report Attributes | Statistics |

| Market Size in 2024 | USD 207.38 Billion |

| Market Size in 2025 | USD 273.75 Billion |

| Market Size by 2034 | USD 4450.34 Billion |

| Market Growth Rate (2025 to 2034) | CAGR of 36.3% |

| Dominated Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Level of Automation, Propulsion, Transportation, Vehicle, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

| Top Companies Covered | BMW AG, Audi AG, Ford Motor Company, Daimler AG, Google LLC, General Motors Company, Nissan Motor Company, Honda Motor Co., Ltd., Toyota Motor Corporation, Tesla, Volvo Car Corporation, Uber Technologies, Inc., and Volkswagen AG. |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Autonomous Vehicle Market Key Regional Analysis

How Big is the U.S. Autonomous Vehicle Market?

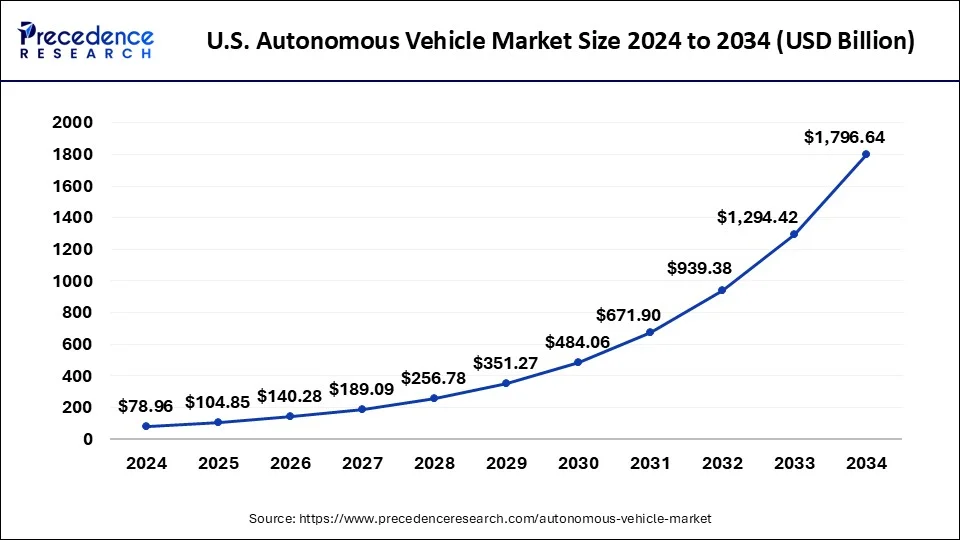

The U.S. autonomous vehicle market size was calculated at USD 78.96 billion in 2024 and is anticipated to reach approximately USD 1,796.64 billion by 2034, with a remarkable CAGR of 37.10% from 2025 to 2034.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1074

How did North America dominate the autonomous vehicle market?

North America dominated the autonomous vehicle market in 2024, due to the region advantages from a strong innovation ecosystem, with a high concentration of technology establishments as well as research institutions actively advancing autonomous vehicle technologies, huge investment in R&D, and a supportive technological as well as regulatory environment, mainly in places like Silicon Valley. Supportive regulatory frameworks and developed infrastructure offer an ideal environment for the testing, development, and deployment of autonomous systems.

Asia Pacific Autonomous Vehicle Market Trends:

Asia-Pacific experiences the fastest growth in the market during the forecast period, due to a combination of technological innovation, solid government support for smart city initiatives, strong manufacturing capabilities from leading automakers and tech firms, and significant urbanization, presenting clear market demands for efficient transportation solutions.

Strong government backing, including policies encouraging smart cities and intelligent transportation systems, offers a favorable environment for autonomous vehicle development and adoption.

Autonomous Vehicle Market Segmentation Analysis

Application Analysis

The transportation segment dominated the autonomous vehicle market in 2024, due to it offering massive potential for enhancing efficiency, safety, and cost-effectiveness across numerous applications such as logistics, ridesharing, as well as personal mobility. Industries are accepting autonomous vehicles to streamline operations, handle traffic congestion, offer convenient commuting, and decrease the expenses and risks linked with human error. The fixed routes as well as long distances involved in commercial transport create autonomous vehicles mainly suitable for industries such as shipping and mining, which are increasingly adopting them to improve their operations.

The defense segment is the fastest growing in the autonomous vehicle market during the forecast period, because of the strategic advantage these systems provide in reducing human risk in high-threat environments, rising operational efficiency, as well as automating dangerous tasks such as surveillance and logistics in combat zones.

Unmanned systems can function for longer durations, in more complex environments, along with greater consistency than human-operated vehicles, enhancing mission effectiveness. Rising defense budgets as well as the strategic push to profit from a technological advantage boost investment in autonomous military platforms.

Level of automation Analysis

The level 1 segment held the largest share in the autonomous vehicle market in 2024, as it represents the most basic as well as widespread form of automation, featuring driver-assistance technologies such as adaptive cruise control as well as lane-keeping assist that are affordable, easy for users to understand, and incorporated into many current vehicle models. Level 1 systems serve as an initial introduction to automated driving, assisting to familiarize users with automated features as well as build consumer trust in the technology.

The level 3 segment experiences the fastest growth in the autonomous vehicle market during the forecast period, as it provides a balance of partial automation as well as human oversight, appealing to both consumers and producers, alongside rising investments, supportive regulations, as well as the ongoing development of the necessary hardware as well as software. Level 3 systems provide a sweet spot by managing most driving tasks but demanding human intervention only when necessary, offering increased convenience along with peace of mind for drivers.

Propulsion Type Analysis

The semi-autonomous segment held the largest share in the autonomous vehicle market in 2024, it provides a balance of enhanced comfort, safety, and convenience via advanced driver-assistance systems such as lane-keeping assist along with automatic emergency braking, which are valuable to safety-conscious users and address driver errors, without demanding the complete technological as well as infrastructural development required for fully autonomous vehicles. Consumers are increasingly requiring these safety features, along with many governments globally are introducing favorable initiatives together with regulations to encourage their installation in vehicles.

The fully autonomous segment experiences the fastest growth in the autonomous vehicle market during the forecast period. It offers basic driver-assistance features such as adaptive cruise control as well as lane-keeping. These systems are already incorporated into many new cars, making them accessible and even affordable for consumers. People are increasingly interested in features that promise improved safety and convenience, driving the requirement for autonomous vehicle technologies.

Vehicle Type Analysis

The commercial segment held the largest share in the autonomous vehicle market in 2024 due to a strong business case for cost reduction, efficiency, and increased safety in logistics and transportation, where autonomous vehicles can optimize supply chains, enhance delivery speed, as well as operate with greater consistency on fixed routes, decreasing fatigue and accidents for drivers.

The surge in online shopping as well as the need for faster, more efficient last-mile delivery services are huge factors pushing the acceptance of autonomous commercial vehicles. In sectors such as mining, the adoption of autonomous trucks assists overcome shortages of skilled labor and decreases accidents.

- Autonomous trucks and vans are being integrated to handle supply chain movements and deliver goods, aligning with the increasing demands of e-commerce.

The industrial segment experiences the fastest growth in the autonomous vehicle market during the forecast period. This is due to the significant operational benefits, like improved productivity, safety, and efficiency, that autonomous technology offers. Autonomous vehicles can function continuously without the demand for breaks, resulting in faster delivery times and enhanced overall efficiency in sectors like logistics and transportation.

Autonomous systems assist in streamlining supply chains, optimize fixed-route logistics, and meet increasing demands for efficient delivery services. There is an increasing network of tech developers, investors, manufacturers, and government support targeted on advancing commercial AV systems, accelerating innovation and development.

Autonomous Vehicle Market Leading Companies:

- BMW AG: Develops advanced driver assistance systems (ADAS) and Level 3 autonomous driving features integrated into luxury vehicles, focusing on safety and comfort.

- Audi AG: Pioneers sophisticated autonomous driving technologies with a focus on sensor fusion and AI, delivering hands-free highway driving capabilities in select models.

- Ford Motor Company: Invests heavily in autonomous vehicle platforms and mobility services, including its Argo AI partnership to accelerate self-driving car development.

- Daimler AG: Leverages extensive experience in commercial and passenger vehicles to develop autonomous trucks and Mercedes-Benz models with advanced automated driving functions.

- Google LLC (Waymo): Leads in fully autonomous ride-hailing services with Waymo, offering Level 4/5 self-driving capabilities using proprietary AI and sensor technologies.

- Toyota Motor Corporation: Focuses on autonomous driving research emphasizing safety, reliability, and gradual deployment through Toyota Research Institute and partnerships.

- Tesla: Provides Autopilot and Full Self-Driving (FSD) software updates enabling semi-autonomous and eventually fully autonomous driving using vision-based AI.

- Volvo Car Corporation: Integrates autonomous technologies prioritizing safety, collaborating with tech firms to bring Level 3 and beyond driving features to its vehicles.

- Uber Technologies, Inc.: Invests in autonomous ride-sharing technologies and last-mile delivery through its Advanced Technologies Group to revolutionize urban transportation.

- General Motors Company: Develops Cruise, a subsidiary focused on launching autonomous electric ride-hailing vehicles and scaling self-driving technologies commercially.

- Nissan Motor Company: Advances ProPILOT Assist systems, blending autonomous features with driver control, aiming for widespread adoption in global markets.

- Honda Motor Co., Ltd.: Innovates in autonomous vehicle technology by combining AI, sensor integration, and human-machine interface design to enhance driver assistance and safety.

Case Study: Waymo’s Scaled Deployment of Autonomous Ride-Hailing Services in Phoenix, Arizona

The autonomous vehicle (AV) industry has been rapidly evolving, fueled by advancements in AI, sensor fusion, and connected infrastructure. Companies such as Waymo, Tesla, and Uber are piloting large-scale projects that reflect the global market’s trajectory, expected to reach USD 4,450.34 billion by 2034 at a CAGR of 36.3%. Among them, Waymo (a subsidiary of Google’s Alphabet Inc.) stands out as one of the most successful real-world deployments of AV technology.

Challenge

Despite strong investment and research momentum, AV adoption faces challenges:

- Public trust and safety concerns surrounding full self-driving capabilities.

- Regulatory complexity, with different U.S. states applying varied testing and approval standards.

- High development costs, as building reliable Level 4/5 autonomous systems requires billions in R&D, plus infrastructure integration for vehicle-to-everything (V2X) communication.

- Scalability issues, since transitioning from pilot fleets to mass-market ride-hailing services requires operational stability, consumer acceptance, and regulatory clearance.

Waymo aimed to demonstrate commercial viability, strengthen regulatory confidence, and validate consumer trust by deploying an autonomous ride-hailing fleet in real-world conditions.

Strategy and Execution

Waymo adopted a phased deployment approach in Phoenix, Arizona, a city with favorable climate and regulatory openness:

-

Technology Stack Development

- Integrated LiDAR, radar, cameras, and ultrasonic sensors with AI-driven deep learning algorithms to deliver high-precision object detection.

- Developed Waymo Driver, its proprietary self-driving software, capable of Level 4 automation.

-

Pilot Launch (2018–2020)

- Began offering rides to early-access customers in suburban Phoenix, with safety drivers inside vehicles.

- Gradually expanded service zones and removed safety drivers in limited areas, building public trust.

-

Commercial Rollout (2021–2023)

- Launched the Waymo One app, allowing riders to book fully driverless rides without human operators.

- Expanded its service to more neighborhoods, increasing ride availability during peak hours.

-

Scaling Partnerships

- Partnered with Lyft and Uber (2023) to integrate Waymo’s driverless rides into their platforms, expanding access to millions of users.

- Collaborated with logistics firms to test autonomous trucking services, diversifying business applications.

Results

- Consumer Adoption: Waymo has logged over 20 million autonomous miles on public roads and billions of miles in simulation, making it the industry’s most road-tested system.

- Market Validation: The commercial ride-hailing service in Phoenix has become the world’s first large-scale driverless taxi service, providing evidence of AV feasibility.

- Regulatory Impact: Waymo’s safety record has influenced regulators to expand AV testing approvals across multiple U.S. states.

- Industry Ripple Effect: The success encouraged Tesla, Uber, Pony.ai, and others to accelerate their robotaxi and AV commercialization plans.

Lessons Learned

- Phased deployment builds trust: Gradually scaling from pilot programs to public fleets helped ease safety concerns.

- Strategic geography matters: Selecting Phoenix, with its wide roads and favorable climate, minimized environmental variables.

- Partnerships amplify scale: Integrating with Uber and Lyft showcased how collaborations can accelerate adoption and consumer accessibility.

- Regulatory collaboration is critical: Working closely with state and local governments was essential to scaling deployment safely.

Implications for the Global AV Market

Waymo’s case demonstrates how AI-driven automation, combined with strong regulatory partnerships, can transform AV from concept to reality. It validates the transportation segment’s dominance (93.41% share in 2024) and strengthens the role of ride-hailing fleets as the commercial anchor of autonomous vehicles.

As the global AV market heads toward USD 4.45 trillion by 2034, Waymo’s success story will likely serve as a blueprint for other regions—particularly in Asia-Pacific, where rapid urbanization and smart city programs are accelerating adoption.

Recent Developments:

- On June 17, 2025, Pony.ai unveiled its Gen‑7 Robotaxi at the Hong Kong Auto Expo, featuring 34 sensors and a 70% reduction in ADK hardware costs, designed for large-scale Level 4 deployment. (Source- Autonomous Vehicle International)

- On June 22, 2025 – Tesla launched its first robotaxi pilot in Austin, Texas, deploying 10–20 Model Y vehicles equipped with Full Self-Driving (FSD) software for flat-rate rides within a geofenced zone. (Source- Fortune India)

- On July 17 2025, Uber announced a \$300 million investment in Lucid and a partnership with Nuro to launch 20,000 Gravity SUV-based robotaxis, with deployment scheduled to begin in late 2026. (Source- Reuters)

- In January 2025, a leading company in the world, named Sony and Honda, collaborated and planned to launch an electric vehicle with the name Afeela EV in the U.S. and Japan by the end of 2026. This automobile will be equipped with various AI technologies to support self-driving capabilities. (Source: https://auto.hindustantimes.com/)

Autonomous Vehicle Market Segments Covered in the Report

By Application

- Defense

- Transportation

- Commercial transportation

- Industrial transportation

By Level of Automation

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

By Propulsion Type

- Semi-autonomous

- Fully Autonomous

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Regions

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1074

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Automated Guided Vehicle Market: Explore how automation is reshaping logistics and manufacturing efficiency

➡️ Autonomous Last Mile Delivery Market: See how drones and robots are transforming final-mile logistics

➡️ Generative AI in Automotive Market: Discover how AI-driven design and automation are powering next-gen vehicles

➡️ Passenger Vehicle ADAS Market: Track growing adoption of advanced driver assistance for road safety

➡️ Artificial Intelligence in Self-Driving Cars Market: Analyze how AI accelerates the path to full vehicle autonomy

➡️ Automotive Software Market: Understand how digital platforms and connectivity are redefining mobility

➡️ Autonomous Agents Market: Gain insights into how intelligent agents are driving real-time decision-making

➡️ Robotaxi Market: Explore the rise of shared autonomous fleets and urban mobility solutions

➡️ Industrial Vehicle Market: Learn how electrification and automation are changing industrial transport

➡️ Autonomous Mobile Robots Market: Discover how AMRs are optimizing warehouses and smart factories

➡️ Autonomous Vehicle Sensors Market: Track advancements in LiDAR, radar, and vision systems for self-driving

➡️ Self-Driving Cars Market: Examine how consumer adoption and regulations shape autonomous mobility

➡️ Autonomous Vehicle Chips Market: See how high-performance processors power next-gen driving intelligence

➡️ Self-Driving Cars and Trucks Market: Review leading players shaping the autonomous mobility landscape

➡️ Self-Driving Cars and Trucks Market: Analyze adoption trends across passenger and commercial autonomous vehicles

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.